- English

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Greek

- German

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

Are Nitrile Gloves More Expensive?

Picture this: you're managing procurement for an industrial facility, and your glove budget has doubled in the past year. You're not alone. Understanding whether nitrile gloves justify their premium price becomes critical when protecting your workforce while controlling costs. Yes, nitrile gloves are generally more expensive than latex or vinyl alternatives, typically ranging from $0.10 to $0.30 per glove compared to cheaper options. However, when sourcing custom nitrile fully coated gloves from reliable manufacturers, the superior protection, durability, and long-term cost savings often outweigh the initial investment, especially for high-risk industrial environments where worker safety cannot be compromised. The price difference stems from complex manufacturing processes, synthetic raw material costs, and exceptional protective qualities that make nitrile the preferred choice across medical, industrial, and food service sectors. This comprehensive analysis explores why nitrile gloves command higher prices and whether they deliver value worth paying for, helping you make informed procurement decisions for your organization.

Understanding the True Cost of Custom Nitrile Fully Coated Gloves

When evaluating glove expenses, the sticker price tells only part of the story. Custom nitrile fully coated gloves represent a specialized category designed for demanding industrial applications where standard disposable gloves simply cannot perform. Unlike thin examination gloves, heavy-duty nitrile fully coated gloves provide comprehensive hand protection with complete coverage from fingertips to cuff, making them indispensable in oil and gas operations, chemical processing, automotive manufacturing, and construction environments. The manufacturing complexity behind these gloves explains much of their cost structure. Production begins with synthetic nitrile rubber created through polymerization of acrylonitrile and butadiene, materials often called "black gold" in the chemical industry due to price volatility. Acrylonitrile alone significantly impacts overall production costs, and global supply chain disruptions can cause dramatic price fluctuations. The polymerization process requires sophisticated equipment operating under precisely controlled conditions, with production lines stretching over 200 meters and maintaining temperatures within half-degree tolerances. Beyond raw materials, the coating process adds substantial value and expense. Heavy-duty nitrile fully coated gloves undergo multiple dipping cycles to achieve proper thickness and durability, followed by vulcanization processes that chemically bond the layers and enhance mechanical strength. Surface treatments create textured grip patterns, such as sandy finishes that maintain effectiveness even when handling oily or wet materials. Each production stage requires quality control checkpoints, specialized equipment investments, and skilled technicians, all contributing to higher manufacturing costs compared to simpler glove types. China nitrile fully coated gloves manufacturers have invested heavily in production capacity and quality systems to meet international demand. However, recent tariff implementations and trade regulations have further complicated pricing structures, making direct partnerships with established manufacturers increasingly valuable for consistent supply and predictable costs.

-

Raw Material Economics and Supply Chain Factors

The cost foundation for nitrile gloves rests heavily on petroleum-based feedstocks. Butadiene, comprising approximately 50% of nitrile rubber composition, derives from oil refining processes. Global oil price volatility directly translates to nitrile glove price fluctuations, creating unpredictability in procurement budgets. When crude oil prices surge, manufacturers face increased production costs that inevitably pass through to end users. Additionally, unexpected plant shutdowns, whether due to maintenance, natural disasters, or regulatory actions, can create sudden butadiene shortages that spike prices industry-wide. Natural disasters and climate events compound supply instability. Flooding in Southeast Asian rubber-producing regions affects not only natural latex supplies but also disrupts entire manufacturing ecosystems, including facilities producing synthetic alternatives. Transportation infrastructure damage extends lead times and increases freight costs. Political instability, labor disputes, and environmental regulations in manufacturing regions create additional uncertainties that buyers must navigate when securing glove supplies. The pandemic permanently altered glove market dynamics. Pre-2020, nitrile glove boxes averaged around $3 per unit. During peak pandemic demand, prices skyrocketed to $32 or higher, representing over 1000% increases. While prices have moderated from pandemic peaks, they remain significantly elevated compared to historical norms. Global demand increased by 45% since early 2020 and has largely sustained at higher levels as industries that previously used cheaper alternatives recognized nitrile's superior protective qualities. This structural demand shift supports higher baseline pricing. Custom nitrile fully coated gloves face additional cost pressures beyond disposable examination gloves. Heavier gauge requirements, specialized coating formulations for industrial applications, and certification requirements for chemical resistance all add incremental expenses. However, these features deliver protection levels that justify premium pricing when worker safety depends on reliable barrier performance against hazardous substances.

Comparing Value: Custom Nitrile Fully Coated Gloves Versus Alternatives

Making informed glove purchasing decisions requires understanding performance differences, not just price comparisons. While vinyl gloves may cost $0.03 to $0.08 per glove and latex ranges from $0.05 to $0.15, these apparent savings often disappear when factoring in replacement frequency, contamination risks, and worker safety considerations. Custom nitrile fully coated gloves typically cost more upfront but deliver superior durability that extends wear time and reduces change frequency, directly impacting total cost of ownership. Vinyl gloves, manufactured from polyvinyl chloride (PVC), serve adequately for low-risk, short-duration tasks. However, their poor chemical resistance, tendency to tear easily, and loose fit make them unsuitable for industrial settings involving solvents, oils, or mechanical hazards. Workers handling chemicals in vinyl gloves face penetration risks that compromise safety. Additionally, vinyl's stiff material reduces tactile sensitivity and comfort during extended wear, decreasing productivity and increasing hand fatigue. Environmental concerns surrounding PVC production and disposal add hidden costs not reflected in purchase prices.

Latex gloves offer better elasticity and comfort than vinyl but present significant allergy concerns. Approximately 8-12% of healthcare workers and 1-6% of the general population have developed latex sensitivity or allergies, ranging from mild skin reactions to severe anaphylactic responses. Organizations using latex gloves must implement allergy screening programs, stock alternative options, and manage potential liability exposure. These administrative burdens and risks make latex increasingly less attractive despite competitive pricing. Furthermore, latex provides limited chemical resistance compared to nitrile, restricting its suitability for industrial applications. Heavy-duty nitrile fully coated gloves eliminate allergy concerns while delivering exceptional chemical resistance to oils, petroleum products, mild acids, alkalis, and many solvents. Their superior puncture and abrasion resistance means gloves withstand rough surfaces and sharp edges that would quickly compromise thinner alternatives. The full coating design ensures complete hand protection from fingertips through wrists, preventing exposure through gaps or seams. These performance advantages translate to fewer workplace injuries, reduced contamination incidents, and lower overall safety costs when properly accounted.

-

Long-Term Cost Analysis and Return on Investment

Smart procurement professionals evaluate total cost of ownership rather than purchase price alone. Custom nitrile fully coated gloves demonstrate value through multiple cost-saving mechanisms. First, extended wear life reduces consumption volumes. Where workers might use three pairs of vinyl gloves during a shift, one pair of heavy-duty nitrile gloves often suffices, cutting per-worker glove expenses despite higher unit costs. This durability particularly matters in industries with continuous glove use requirements. Second, improved protection reduces workplace injury costs. Chemical burns, dermatitis, and contamination exposures create direct medical expenses, workers compensation claims, and productivity losses. Investing in proper protective equipment prevents these incidents, generating measurable returns. Third-party safety studies consistently demonstrate that adequate hand protection reduces injury rates in high-risk environments, validating the business case for quality gloves over cheap alternatives. Third, china nitrile fully coated gloves suppliers offering bulk purchasing programs provide economies of scale that narrow price gaps with inferior alternatives. Volume discounts, consolidated shipping, and streamlined ordering processes reduce per-unit costs while ensuring consistent supply. Establishing partnerships with reliable manufacturers like Foshan Lifa Building Materials Co., Ltd. provides access to competitive pricing structures alongside quality assurance and technical support. Fourth, regulatory compliance costs decrease with certified products. Heavy-duty nitrile fully coated gloves meeting EN388 and EN374-1:2016 Type A standards demonstrate verified performance against mechanical risks and chemical permeation. Using certified protective equipment simplifies safety program documentation, reduces inspection deficiencies, and mitigates liability exposure. These compliance benefits carry real financial value often overlooked in simple price comparisons.

Quality Factors That Justify Premium Pricing for Industrial Nitrile Gloves

Not all nitrile gloves offer equivalent protection or performance. Understanding quality differences helps explain price variations and guides appropriate product selection. Custom nitrile fully coated gloves manufactured to rigorous standards incorporate several premium features that cheaper options lack. Thickness represents one obvious differentiator, with industrial-grade gloves typically measuring 0.35mm to 0.70mm compared to 0.05mm to 0.15mm for disposable examination gloves. This substantial thickness provides mechanical protection against abrasions, cuts, and punctures while maintaining flexibility for manual dexterity. Coating formulation significantly impacts performance and cost. Basic nitrile formulations offer general chemical resistance, while specialized compounds enhance specific properties. Some formulations optimize acid resistance for chemical processing environments, others improve grip in oily conditions for automotive applications, and still others enhance cut resistance for handling sharp materials. These specialized coatings require additional development investment and raw material expenses reflected in premium pricing but deliver superior protection for targeted applications.

Manufacturing quality control separates premium products from economy alternatives. Reputable manufacturers like those producing china nitrile fully coated gloves for international markets implement multiple inspection stages throughout production. Automated optical systems detect coating irregularities, pin holes, or thin spots that compromise protection. Batch testing verifies chemical resistance, mechanical strength, and dimensional consistency. These quality assurance measures add production costs but ensure reliable performance under actual working conditions. Certification expenses also contribute to premium pricing. Achieving EN388 mechanical risk ratings and EN374 chemical resistance certifications requires extensive third-party laboratory testing. Manufacturers must submit samples for puncture resistance, abrasion resistance, tear resistance, and chemical permeation testing. The certification process takes months and costs tens of thousands of dollars per product line. FDA compliance for food-safe gloves requires even more rigorous validation. These certification investments protect end users by providing verified performance data but necessarily increase product costs.

-

Selecting the Right Custom Nitrile Fully Coated Gloves for Your Application

Maximizing value from nitrile glove investments requires matching product specifications to actual working conditions. Overspecifying gloves wastes money on unnecessary protection levels, while underspecifying creates safety gaps. Begin by assessing workplace hazards comprehensively. What chemicals do workers handle, at what concentrations, and for how long? What mechanical risks exist from sharp edges, rough surfaces, or pinch points? What environmental factors like temperature extremes or wet conditions affect glove performance? Answering these questions guides appropriate product selection. Thickness requirements balance protection against dexterity needs. Heavy-duty applications involving sustained chemical exposure or severe mechanical hazards justify thicker gloves rated for extended protection. Tasks requiring fine motor control or frequent tool use may prioritize thinner profiles that maintain tactile sensitivity. Many organizations find that providing two glove types—heavier options for high-risk tasks and lighter alternatives for general work—optimizes both safety and cost efficiency. Grip surface selection impacts productivity and safety. Sandy finish textures excel in oily or wet environments common in automotive and petrochemical industries, maintaining secure grip when smooth surfaces would slip dangerously. Flat finishes suit precision assembly work where texture might interfere with component handling. Evaluating actual working conditions and soliciting user feedback identifies grip patterns that enhance rather than hinder work performance. Size availability matters more than many procurement teams realize. Ill-fitting gloves compromise both protection and productivity. Tight gloves cause hand fatigue and may tear during donning, while loose gloves reduce dexterity and increase contamination risks. Custom nitrile fully coated gloves offered in comprehensive size ranges from small through double extra-large accommodate diverse workforce demographics. Providing proper sizing improves user compliance with safety protocols and reduces waste from damaged oversized gloves.

Market Trends and Future Pricing Outlook for Industrial Nitrile Gloves

Understanding current market dynamics helps organizations plan procurement strategies and budget effectively. Several converging factors suggest continued upward price pressure on nitrile gloves through 2025 and beyond. First, structural demand increases show no signs of reversing. Industries that adopted nitrile gloves during the pandemic—including retail, logistics, and food service sectors—continue using them as standard practice. This expanded user base competes with traditional medical and industrial consumers for limited production capacity. Second, manufacturing capacity additions lag demand growth. Building new nitrile glove production facilities requires 18 to 24 months and substantial capital investment in specialized equipment. While Asian manufacturers have announced capacity expansions, new production comes online gradually relative to immediate market needs. This supply-demand imbalance supports elevated pricing levels, particularly for specialized products like heavy-duty nitrile fully coated gloves requiring more complex manufacturing processes. Third, raw material constraints persist. Butadiene production depends on oil refinery operations planned around fuel demand, not glove manufacturing needs. Economic shifts affecting transportation fuel consumption can limit butadiene availability regardless of nitrile rubber demand. Building new chemical production capacity to specifically serve glove manufacturers faces similar timeline challenges as glove factory construction. These upstream supply limitations create price floors below which manufacturers cannot profitably operate. Fourth, trade policies and tariff structures increasingly affect glove pricing and availability. Recent tariff implementations on Chinese-manufactured gloves dramatically reshaped cost structures, with some products facing tariff rates exceeding 100%. These policies push procurement toward Southeast Asian suppliers in Malaysia, Thailand, and Indonesia, but available capacity in these regions cannot immediately absorb demand shifts. China nitrile fully coated gloves manufacturers seeking to maintain export markets must navigate complex regulatory environments while competing with regional alternatives, creating pricing uncertainties.

-

Strategic Sourcing Recommendations for Procurement Professionals

Forward-thinking procurement strategies can mitigate price volatility and ensure reliable supply in uncertain markets. First, establish direct manufacturer relationships rather than relying solely on distributors or brokers. Direct partnerships with suppliers like Foshan Lifa Building Materials Co., Ltd. provide price transparency, production visibility, and preferential allocation during supply constraints. These relationships also enable custom product development tailored to specific application requirements, potentially reducing costs through specification optimization. Second, implement strategic inventory management balancing carrying costs against price volatility and supply risk. While just-in-time inventory minimizes working capital requirements, maintaining strategic safety stock protects against unexpected disruptions and price spikes. Organizations with adequate storage capacity might consider larger purchase commitments when prices dip, essentially hedging against future increases. However, glove shelf life considerations require rotating stock to prevent expiration waste. Third, explore alternative product options that maintain safety standards while managing costs. For example, reserving premium custom nitrile fully coated gloves for highest-risk applications while using lighter-gauge nitrile gloves for moderate-risk tasks optimizes total spending without compromising worker protection. Conducting detailed task analyses identifies opportunities for product differentiation based on actual hazard exposure rather than applying single product types across all applications. Fourth, leverage volume consolidation opportunities. Organizations with multiple facilities or departments often purchase gloves independently, missing opportunities for consolidated buying power. Standardizing products across locations where possible and aggregating volume creates negotiating leverage for better pricing, streamlined logistics, and consistent quality. Working with suppliers offering OEM/ODM services enables creating standardized specifications that balance performance requirements with cost efficiency.

Conclusion

Nitrile gloves cost more than vinyl or latex alternatives due to synthetic raw materials, complex manufacturing, and superior protective performance. However, custom nitrile fully coated gloves deliver exceptional value through extended durability, comprehensive chemical resistance, and proven workplace safety benefits that justify premium pricing for industrial applications requiring reliable hand protection.

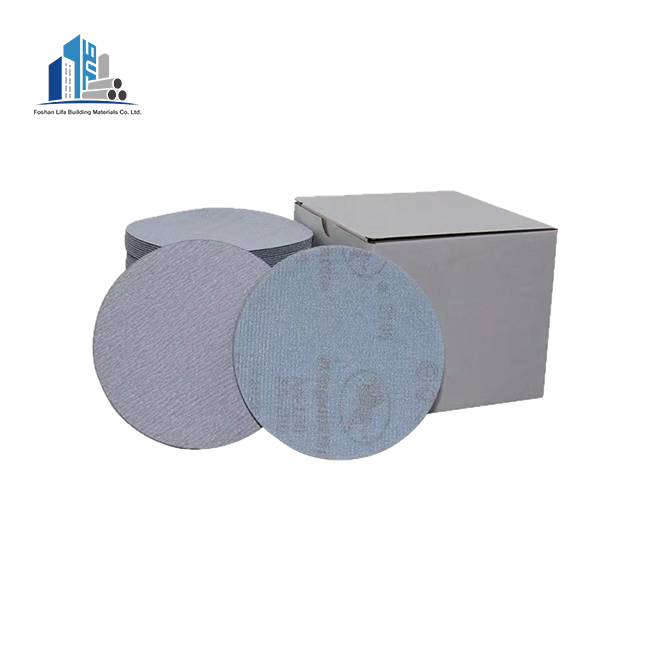

Cooperate with Foshan Lifa Building Materials Co., Ltd.

As a leading China custom nitrile fully coated gloves manufacturer, China custom nitrile fully coated gloves supplier, and China custom nitrile fully coated gloves factory, Foshan Lifa Building Materials Co., Ltd. offers China custom nitrile fully coated gloves wholesale solutions with competitive custom nitrile fully coated gloves price structures. Our high quality custom nitrile fully coated gloves for sale meet international standards including ISO9001, EN388, and EN374-1:2016, backed by complete certifications and rigorous quality control processes. With extensive inventory for immediate shipment, experienced R&D teams providing custom OEM/ODM solutions, and professional staff delivering exceptional communication throughout the order process, we serve as your trusted supply chain partner. Headquartered in Foshan's Pearl River Delta economic circle with products successfully exported to over 30 countries including South America, the EU, Australia, the Middle East, and Southeast Asia, we bring competitive cost advantages and reliable quality assurance to your procurement program. Contact our team at wz@jiancaiqy.com today to discuss your specific requirements and discover how our heavy-duty nitrile fully coated gloves can enhance workplace safety while optimizing your protective equipment budget. Save this article for quick reference when evaluating your glove procurement strategy.

References

1. Malaysian Rubber Glove Manufacturers Association. "Medical Glove Pricing and Raw Material Supply Analysis." Industry Report Series, 2024.

2. Smith, Jennifer and Robert Chen. "Economic Factors Influencing Disposable Glove Markets: A Comprehensive Analysis." Journal of Industrial Safety and Supply Chain Management, Vol. 18, 2024.

3. International Safety Equipment Association. "Comparative Performance Standards for Chemical Resistant Gloves: EN388 and EN374 Certification Guidelines." Technical Standards Publication, 2023.

4. Thompson, Michael. "Supply Chain Dynamics in Personal Protective Equipment: Post-Pandemic Market Restructuring." Global Manufacturing Review, Vol. 42, 2024.

Learn about our latest products and discounts through SMS or email